Individuals with a current withholding percentage elected on Arizona Form A-4P or Arizona Form A-4Vmay complete a new form to change the previous withholding amount or percentage. This exemption must be renewed annually, similar to the federal Form W-4 requirement. Existing employees may also complete the form to change the previous withholding amount or percentage.Įmployees who expect no Arizona income tax liability for the calendar year may claim an exemption from Arizona withholding.

All new employees subject to Arizona income tax withholding must complete Arizona Form A-4 within five days of employment.

/taxbrackets2020singlefilerv2-2965d5b034f84d2aa2441b0f028f3cd3.jpg)

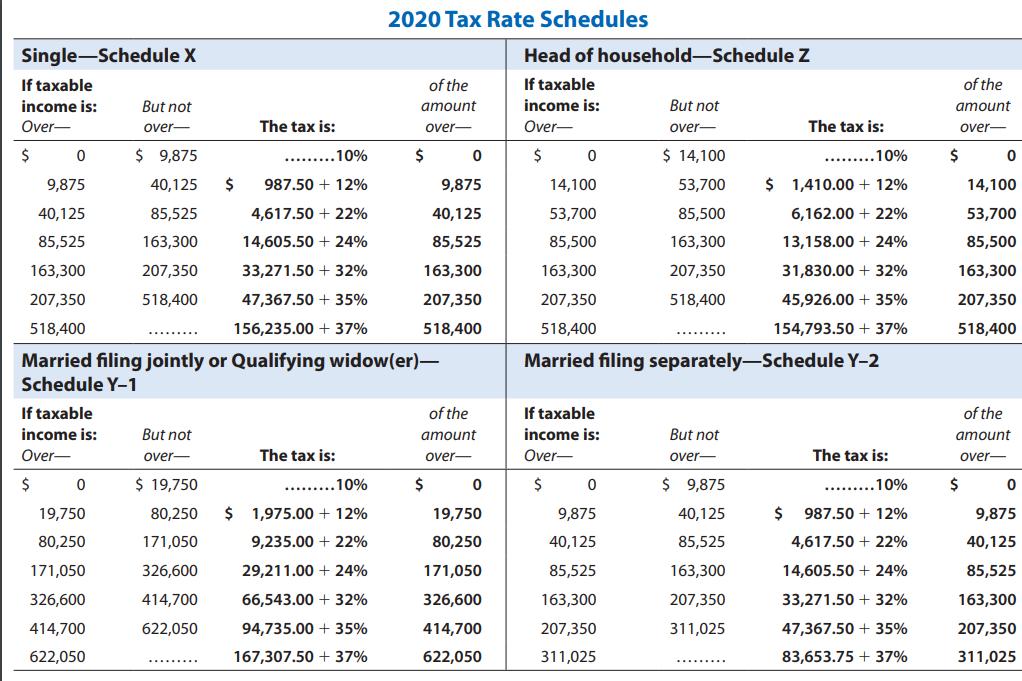

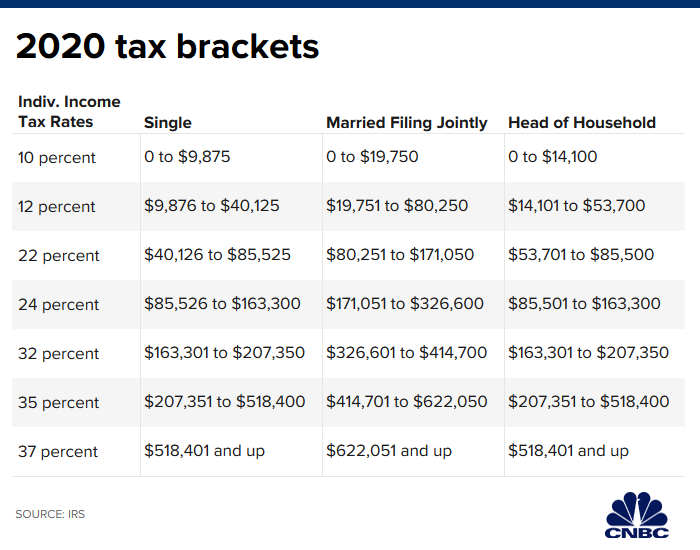

Employee Arizona gross wages are the same as those for federal tax purposes and should match the federal gross taxable wages shown for the year in box 1 of the employee's Form W-2.įollowing are the withholding rates in effect for 2020 (unchanged from 2019):Īrizona's current withholding tables are based on a percentage of gross taxable wages. The income tax schedule is reduced from the previous five tax brackets to four tax brackets, with a reduction in income tax rates within the brackets.Ģ020 withholding rates remain the same as for 2019Īrizona employers withhold state income tax from employee gross wages at the percentage the employee elects on Form A-4, Employee's Arizona Withholding Election.Taxpayers may increase their standard deduction by 25% of the charitable donations that would have been claimed as an itemized deduction.

A $100 child tax credit per dependent under age 17 is available, phasing out for high-income earners.Personal and dependent exemption amounts are removed from Arizona law.Arizona law matches the federal standard deduction amount ($12,200 for single/married filing separate, $18,350 for head of household and $24,400 for married filing jointly).Current employees who previously submitted Form A-4 need not submit a new 2020 form, but may do so to elect a different Arizona withholding percentage or to change any extra amount to be withheld from their paycheck.Īrizona law and regulations do not allow for a flat supplemental rate of withholding.īudget bill provisions affecting individual income tax lawĪccording to a news release by the Arizona Department of Revenue, the following are the changes to state individual income tax law, beginning in 2020 and effective for tax year 2019: If the employee fails to submit Form A-4, the employer must withhold 2.7% of the employee's wages until the employer receives a completed Form A-4 from that employee. It is required that new employees submit this form to their employers, in addition to the federal Form W-4. The 2020 Form A-4, Employee's Arizona Withholding Election, from which the employee elects the percentage of withholding from gross taxable wages, shows the same seven percentage options (0.8% to 5.1%) as for 2019.

AZ TAX TABLES 2020 CODE

Arizona budget bill law changes affect 2019 – 2020 individual income tax, 2020 withholding rates unchanged, 2019 Form W-2 filing remindersĪn omnibus budget bill enacted in mid-2019 ( HB 2757) makes several changes to Arizona state individual income tax law, including conformity with the Internal Revenue Code as of January 1, 2019, and consolidation of the 2019 income tax brackets.

0 kommentar(er)

0 kommentar(er)